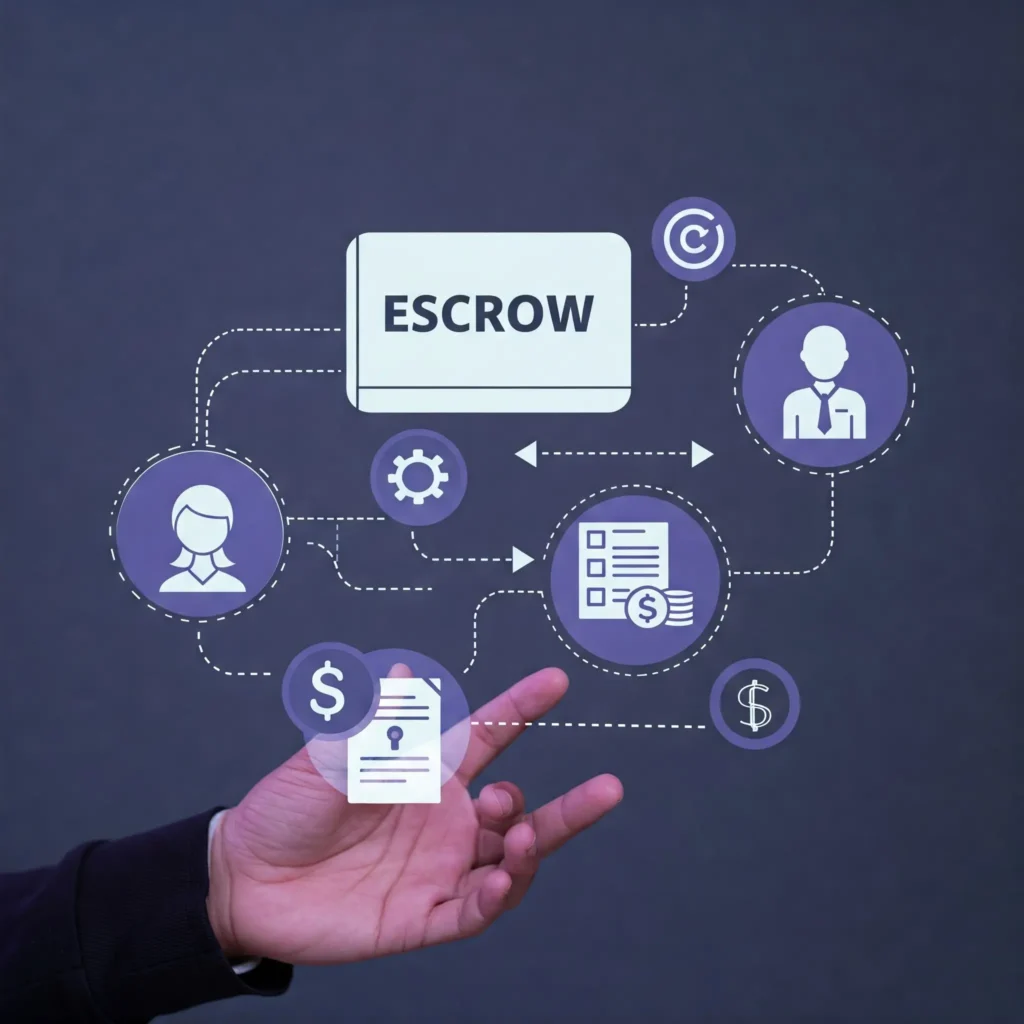

Escrow is a financial arrangement that plays a critical role in a wide range of transactions, from real estate deals to online purchases. It provides a secure way for two parties to engage in transactions by ensuring that money, assets, or documents are held by a neutral third party until specific conditions are met. This blog will delve into what escrow is, how it works, its benefits, and its various applications in different industries.

What is Escrow?

Escrow is a legal concept in which a neutral third party, known as an escrow agent, holds assets or funds on behalf of two parties involved in a transaction. The escrow agent ensures that the terms of the agreement are fulfilled before releasing the funds or assets to the intended recipient. This mechanism helps mitigate risks associated with fraud, disputes, or non-compliance.

Escrow is commonly used in real estate, e-commerce, mergers and acquisitions, legal settlements, and financial transactions that require security and trust.

How Does Escrow Work?

The escrow process typically follows these steps:

- Agreement: The buyer and seller agree on terms and conditions of the transaction, including the use of an escrow service.

- Deposit: The buyer deposits funds, documents, or assets into the escrow account.

- Verification: The escrow agent verifies that all conditions of the agreement are met, including inspections, approvals, or contract terms.

- Release: Once all conditions are satisfied, the escrow agent releases the funds or assets to the seller or relevant party.

- Completion: The transaction is finalized, and both parties fulfill their obligations.

Benefits of Using Escrow

Escrow services provide several advantages, including:

1. Security and Trust

Escrow minimizes the risk of fraud by ensuring that funds or assets are only released when all terms are met. This adds a layer of security for both buyers and sellers.

2. Dispute Resolution

Escrow agents act as neutral mediators, reducing the chances of disputes. If disagreements arise, the escrow service ensures fairness in resolving issues.

3. Compliance Assurance

For transactions involving regulatory requirements, escrow ensures that all legal obligations and conditions are met before the transaction is completed.

4. Convenience in Transactions

Escrow simplifies complex transactions by managing fund transfers and documentation, ensuring a smoother process for all parties involved.

Applications of Escrow in Different Industries

1. Real Estate Transactions

Escrow is widely used in real estate to protect both buyers and sellers. When purchasing a property, the buyer places the funds in escrow until inspections, appraisals, and contract obligations are completed. Once all conditions are met, the funds are transferred to the seller, and the ownership is legally transferred to the buyer.

2. E-Commerce and Online Marketplaces

Many online platforms use escrow services to protect buyers and sellers from fraud. For example, in high-value online transactions, buyers deposit funds into escrow, and the seller ships the product. The funds are only released to the seller once the buyer confirms receipt and satisfaction.

3. Freelance and Contract Work

Escrow is commonly used in freelance work and contract-based projects. Clients deposit funds into escrow before work begins. Once the work is completed and approved, the escrow service releases payment to the freelancer, ensuring fair transactions.

4. Mergers and Acquisitions (M&A)

During company acquisitions, funds or shares are often placed in escrow to ensure compliance with agreements. This guarantees that all contractual obligations are fulfilled before funds or assets are transferred.

5. Intellectual Property and Software Licensing

In software development, escrow services are used to store source codes or intellectual property, ensuring that the client gains access if the developer fails to meet agreed-upon terms.

Choosing an Escrow Service Provider

When selecting an escrow service, consider the following factors:

- Reputation and Trustworthiness – Choose a reputable escrow provider with a history of successful transactions.

- Security Measures – Ensure that the provider uses secure platforms and follows legal guidelines.

- Fee Structure – Compare costs and service fees before selecting an escrow service.

- Customer Support – A reliable escrow service should offer excellent customer support and dispute resolution mechanisms.

Conclusion

Escrow is a powerful tool that provides security, trust, and fairness in financial transactions. Whether used in real estate, e-commerce, or business acquisitions, escrow helps protect all parties involved by ensuring compliance with contractual agreements. By understanding how escrow works and its applications, individuals and businesses can make informed decisions and conduct transactions with confidence.

As digital transactions continue to rise, escrow services will remain a crucial part of secure financial dealings. Whether you’re a buyer, seller, or service provider, incorporating escrow into your transactions can help you mitigate risks and ensure smoother operations.